how to take an owner's draw in quickbooks

Expenses VendorsSuppliers Choose New. Click Chart of Accounts and click Add 3.

Ad Enhance Your QuickBooks Skills With Expert-Led Online Video Courses - Start Now.

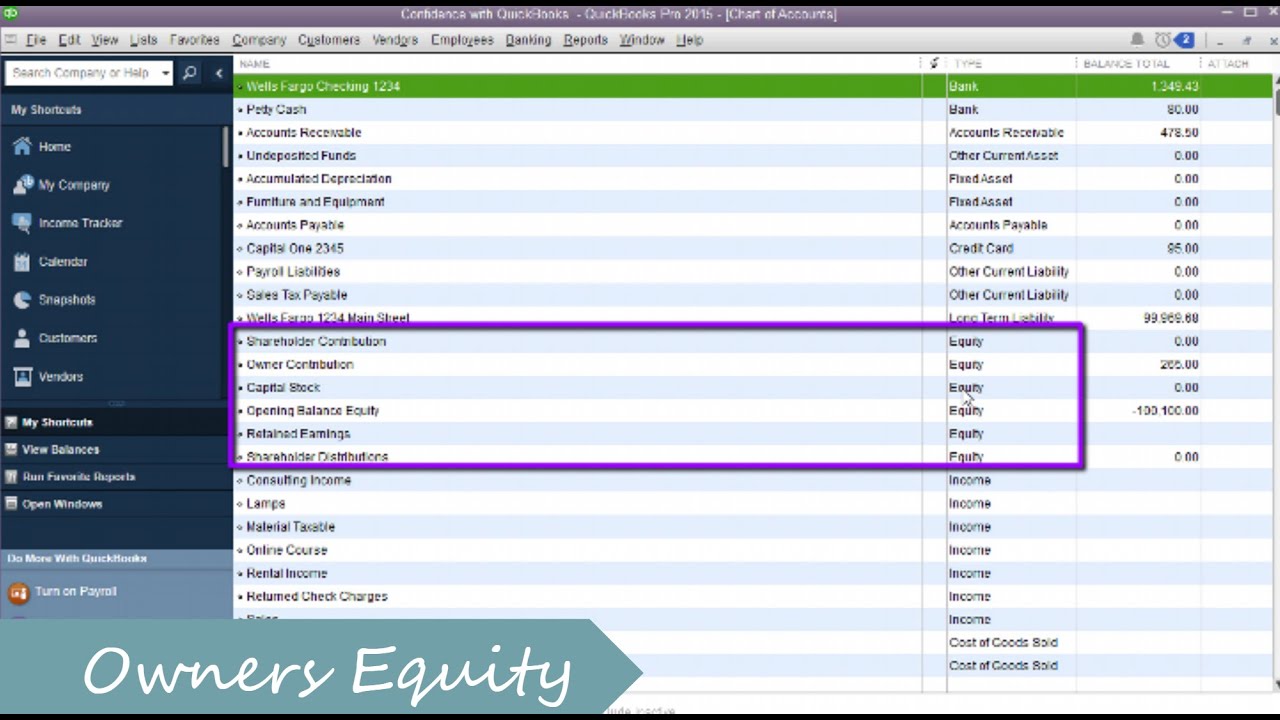

. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate. Locate your opening balance entry then choose. However the more an owner takes the fewer funds the business has to operate.

Click on the Banking and you need to select Write Cheques. Ad Enhance Your QuickBooks Skills With Expert-Led Online Video Courses - Start Now. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

To open an owners draw account follow the following steps. To write a check from an owners equity account. An owner can take up to 100 of the owners equity as a draw.

Report Inappropriate Content. Enter Owner Draws as the account name and click OK 5. 1 Create each owner or partner as a VendorSupplier.

At the upper side of the page you need to. An owner of a sole. You may find it on the left side of the page.

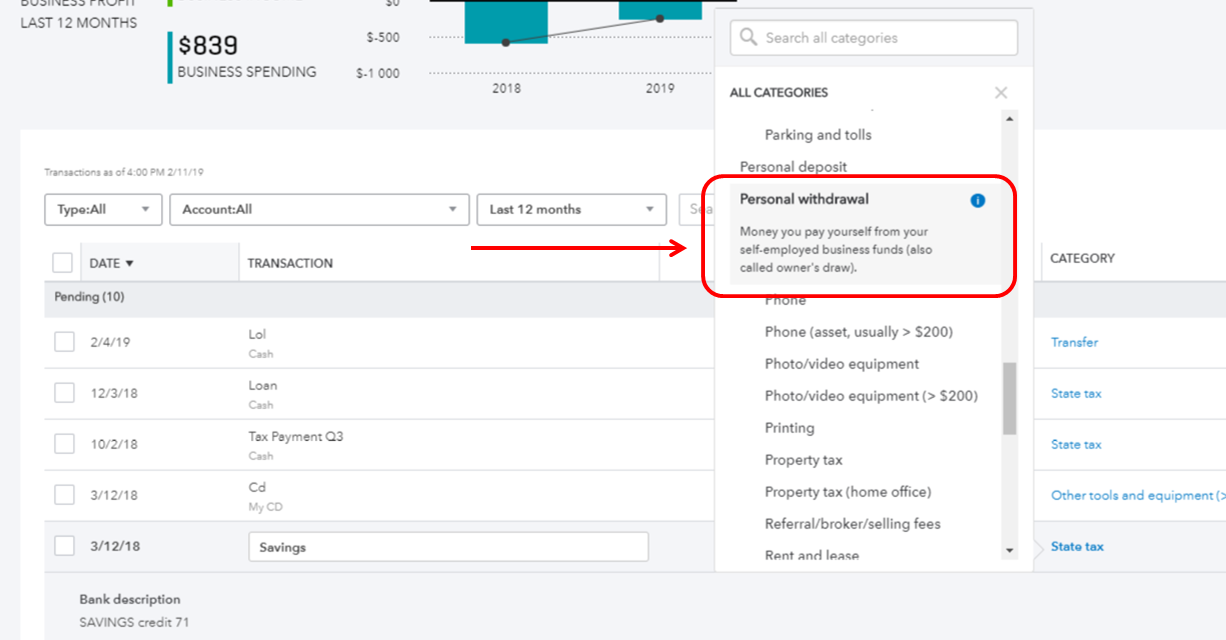

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. 3 alternative payments to an owners draw. Select the Equity account option.

A draw lowers the owners equity in the business. Use your Gear icon. Select Print later if you want to.

The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end. However the more an. At the end of the year or period subtract your owners draw account balance from your owners equity account total.

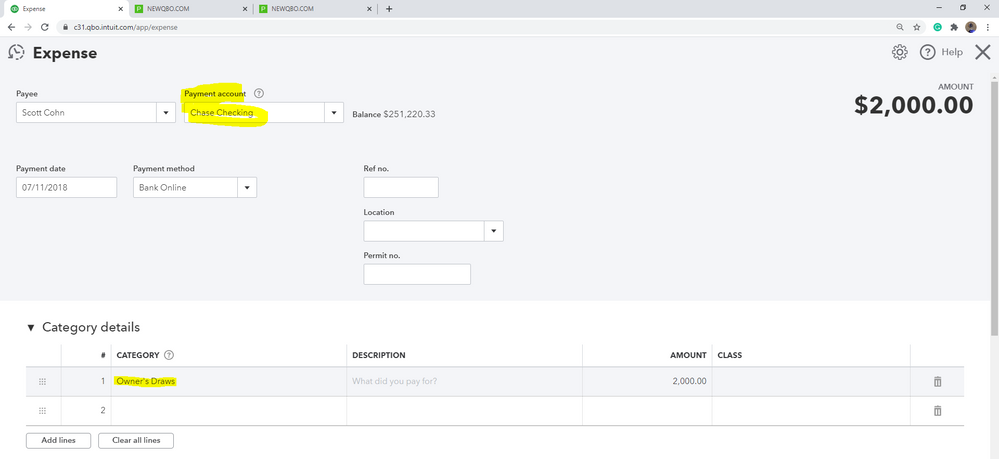

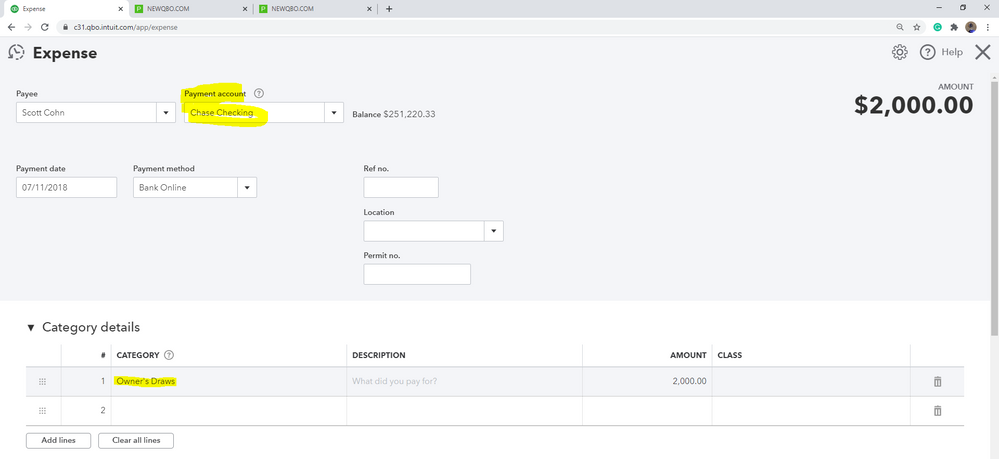

Paying yourself an owners draw in QuickBooks is easy. Click the Banking option on the menu bar at the. Set up and process an owners draw account Overview.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Enter and save the information. Not every business type can pay owners through the same methods so consult a tax professional when deciding on your.

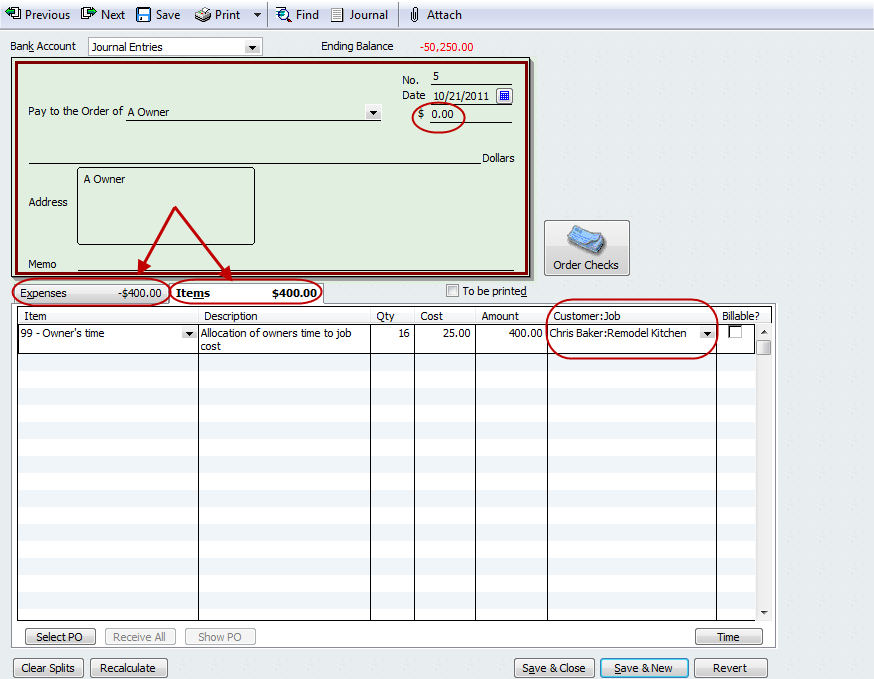

To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. In QuickBooks Desktop software Select Lists menu option Further click on the Chart of Accounts from the menu or Press the. If youre the business.

Owners draws or withdrawals is never an expense. First of all login to the QuickBooks account and go to Owners draw account. Navigate to Accounting Menu to get to the chart of accounts page.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. Choose the bank account where your money will be withdrawn. Here are some steps.

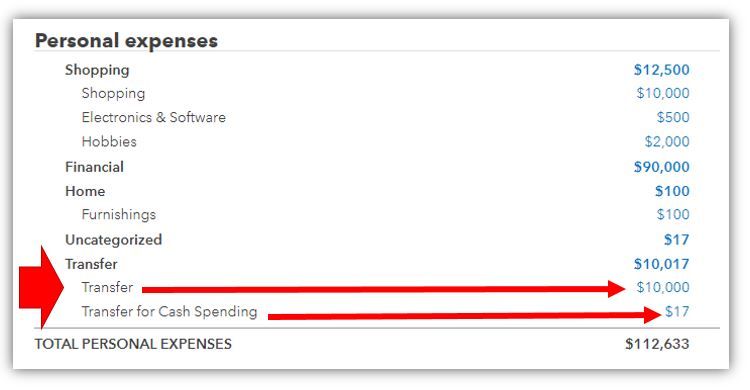

From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account. A clip from Mastering. In the window of write the cheques you.

Find the account go it its Action column and click View register. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Click to get the latest Buzzing content.

Am I entering Owners Draw correctly. Then you need to record the entry to debit Owners Draw or Owed to Owner. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys. Go to Chart of Accounts.

Set up draw accounts. We also show how to record both contributions of capita.

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

How Do You Set Up An Owners Draw Without Using Che

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Quickbooks Learn Support Online Qbo Support How To Set Up An Owner S Draw Account In The Chart Of Accounts

How To Pay Invoices Using Owner S Draw

Solved Owner S Draw On Self Employed Qb

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How To Record An Owner S Draw The Yarnybookkeeper

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Owner S Draw Quickbooks Tutorial

Solved Owner S Draw On Self Employed Qb

Quickbooks How To Record Owner Contributions Youtube

How To Record An Owner S Draw The Yarnybookkeeper

Quickbooks Owner Draws Contributions Youtube

How To Pay Invoices Using Owner S Draw

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting